S&P 500 Banks index: after a 2 months consolidation between early May and early July, the sector caught back the retracement and passed the May peak. The index is now trading over the 200 days moving average and getting a bit overextended short term. This was helped by good quarterly results from a number of US banks, even if they were mainly driven by trading profits. The 100 mark held very well, and we are now establsihing a new support at 128-130. Positive.

Global 1200 financial index: The world financial sector is showing an even better move than the US, being above the early November peak and well above the May and June peak. The index looks more over-extended than the S&P 500 Bank index, standing well above its 200 days moving average; the latter is however turning higher, technically favourable. Positive.

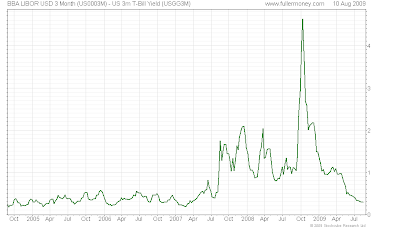

Global 1200 financial index: The world financial sector is showing an even better move than the US, being above the early November peak and well above the May and June peak. The index looks more over-extended than the S&P 500 Bank index, standing well above its 200 days moving average; the latter is however turning higher, technically favourable. Positive. TED spread (LIBOR USD 3 mth - US 3 mth T-bills): The spread is now back to historical average, even slighly below. Positive.

TED spread (LIBOR USD 3 mth - US 3 mth T-bills): The spread is now back to historical average, even slighly below. Positive. USD bank BBB 10 yr - US 10 yr yield: Whilst still elevated, the 7% level is now broken and the spread consistently heads south. Slightly positive.

USD bank BBB 10 yr - US 10 yr yield: Whilst still elevated, the 7% level is now broken and the spread consistently heads south. Slightly positive. OEX volatility: OEX volatility has markedely decreased, back to the summer 2007 when financial troubles appeared first on markets. The moving average is also going south, a positive indicator. Positive.

OEX volatility: OEX volatility has markedely decreased, back to the summer 2007 when financial troubles appeared first on markets. The moving average is also going south, a positive indicator. Positive.

S&P Case Shiller house price index (source: S&P): The latest data (June) published in July show the 4th consecutive month of yoy decrease in the rate of decline. More importantly, the index increased for the first time since June 2006 (151.00 in May for the Composite 10 vs. 150.38 and 139.84 for the composite 20 vs. 139.21 - not seasonnally adjusted). Signs are becoming more encouraging. Neutral.

Oil price: After a short consolidation down to $60/b, oil prices reached $74/b again where some resistance seems to appear. The $60-74 trading range should hold for some time. However, when it breaks uptwards, it will rally very sharply. Positive for the time being.

Oil price: After a short consolidation down to $60/b, oil prices reached $74/b again where some resistance seems to appear. The $60-74 trading range should hold for some time. However, when it breaks uptwards, it will rally very sharply. Positive for the time being. Conclusion: In our last review (July 10), we advise to take profits off the table. Fundamentals in the interbanking market have back to more or less normal levels, economic indicators are getting better, despite a few clouds still hovering around. Equity markets are now pricing a hefty recovery next year ( in the US +4% GDP growth and + 40% earnings growth), which is too agressive at this point. As advised in my previous post: relax, enjoy the summer, take time for the next action. I would add: be alert and prepare for the next move.

Conclusion: In our last review (July 10), we advise to take profits off the table. Fundamentals in the interbanking market have back to more or less normal levels, economic indicators are getting better, despite a few clouds still hovering around. Equity markets are now pricing a hefty recovery next year ( in the US +4% GDP growth and + 40% earnings growth), which is too agressive at this point. As advised in my previous post: relax, enjoy the summer, take time for the next action. I would add: be alert and prepare for the next move.