Since I last wrote about the magnificent 7 in February 2011,

a lot has happened and it is rather appropriate to review where do we stand at

the beginning of 2012.

Despite all discussions about recession/double dip in the US

for most of 2011, it did not occur and growth looks to carry on, whilst at a

moderate pace; this is strikingly different from what we have been witnessing

in Europe since the summer and the inability of European policy makers to put

the eurozone (“EZ”) house in order.

In 2011, the DJ increased 5.5% (the S&P 500 was flat) which

is not so bad given what happened in the world, and in Europe

in particular. If one picked up dividend aristocrats it was a reasonable year in

the US.

In

Februray 2011 I wrote: “Economic

news from the US continue to point towards a continued GDP growth and a

(slowly) improving situation in unemployment; Commercial and Industrial

Loans at All Commercial Banks in the US have definitely passed the trough

and now seems to be well entrenched in an upward move”. . The latter indicator has displayed the 12th

positive number in a row for a total of USD +114 bn (USD -411 bn during the 25

months starting in November 2008) and this points towards a continued growth in

the US

6 months ahead.

Friday’s employment numbers were rather positive at +200k

bringing the unemployment rate down to 8.5%.

Things indeed went in the right direction and 2012 starts

under the same auspice bearing that:

- The FED continues with its low interest rate policy along the yield curve, which is most likely during a Presidential election year and in the current economic environment.

- International investors continue to buy the US debt, which they should in my opinion by the lack of other choice, continuing to believe that the US will tackle one for all its deficit and inflation will be kept in check.

Fast growing economies in the rest of the world keeps up

forging ahead whilst inflation continues to be a real issue (food prices remain

very high in China and India, albeit going down recently). However, this is more

a consequence of a growing population and a faster developing middle class: a

strong engine to growth. In addition, some countries like India are going 2 steps forward and

one backwards in terms of liberalization of their markets (for example opening

up the country to foreign supermarket companies).

The graph below is self-explaining…

S&P 500 Banks index: for over two years, the index

has traded range bound and has yet to decisively to breach the 165 level;

there is no sign this happening any time soon and, conversely, there is no sign

of a deterioration either, US banks continuing to recapitalize thanks to an

unabated FED QE. In my opinion, the level comes from a continuing reappraisal

of the future profitability of banks (less leverage + more controls = lower ROE)

versus their ability to pass on additional costs to customers. Neutral.

Global 1200 financial index: The index broke its 200 MA in May 2011 and several support levels,

reflecting the deepening crisis in the EZ and the need to recapitalize European

banks beyond the official numbers (not talking about OTC derivatives where

nobody knows what the global risk is, even banks on an individual basis

probably do not know their real risk); the solid 800 floor was penetrated without

a whisper and now represents a resistance. The outlook for a number of

Europeans banks is bleak and the introduction of Basle III rules ahead of the

2019 deadline is adding pressure. Negative.

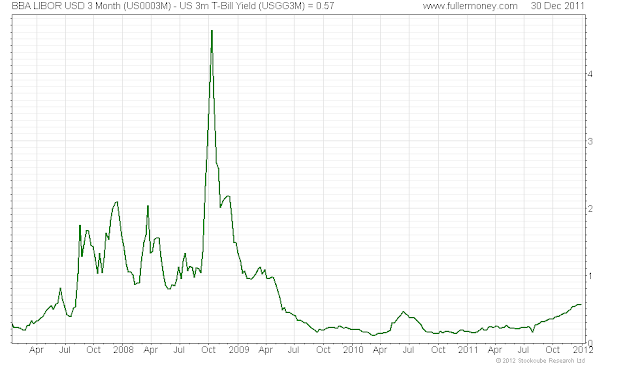

TED spread (LIBOR USD 3 mth - US 3 mth T-bills):

since July, the spread has deteriorated

but in an orderly manner (the OIS displays the same pattern) and is nowhere

near the 2008 crisis levels, with central banks reacting very quickly by opening

USD swap lines and the ECB offering 3 years lines of credit (LTRO) in the tune

of EUR 426 bn. Neutral

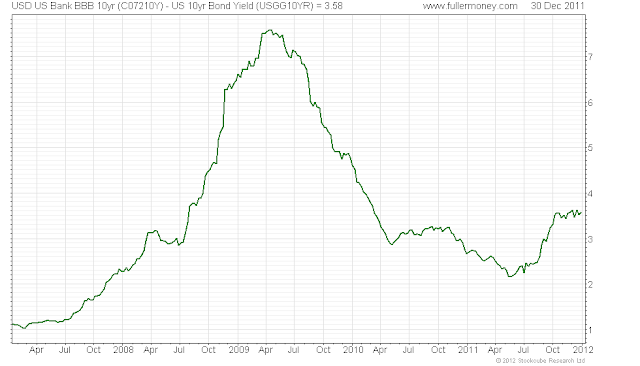

USD bank BBB 10 yr - US 10 yr yield: In July the

spread started to widen markedly, whilst well below the extraordinary stress of 2008-2009, to pause for

the past 2 months. Neutral.

USD bank BBB 10 yr - US 10 yr yield: In July the

spread started to widen markedly, whilst well below the extraordinary stress of 2008-2009, to pause for

the past 2 months. Neutral. OEX volatility: OEX volatility had a spike during the

summer but did not break the high of 2010 and has since come back to the low

20s. Positive.

OEX volatility: OEX volatility had a spike during the

summer but did not break the high of 2010 and has since come back to the low

20s. Positive. S&P Case Shiller house price index: The latest

data for US home values (October) published 27th December have continued

to go down for the 5th consecutive month, only two cities showing

positive numbers.

S&P Case Shiller house price index: The latest

data for US home values (October) published 27th December have continued

to go down for the 5th consecutive month, only two cities showing

positive numbers.

The unadjusted data are negative (-4% since July, the recent

high); adjusted data display the same pattern:

Composite-10: Oct

2011: m/m -1.1%; y/y -3.0%

Composite-20: Oct

2011: m/m -1.2%; y/y -3.4%

As the report comments:

“Some of the other housing

statistics posted relatively healthy figures for November, but it seems that

most of the good news was confined to the multi-family sector. Existing home

sales rose in November, but are still at a low annual rate of about 4.0

million. Single family housing starts also rose, but remain close to record

lows and are still down about 1.5% versus October 2010.”

The recovery did not materialize. Negative.

Oil price: The WTI oil reached a peak of $115 to

settle down in a $80 - $110 range. In

2011, the story was he spread between the WTI and Brent which reached $25

in August reflecting the glut of crude at refineries in the US and the Arab world revolutions with oil

disruptions in Libya.

In the US,

unconventional oil & gas recovery is a game changer which explains low

prices for natural gas at below $4/btu: Neutral.  Conclusion: The

indicators on the banking situation deteriorated, whilst other indicators

are mostly neutral. The macro-economic situation between Europe and the US is diverging

to the advantage of the latter, even if in both cases public finances are in

disarray. The magnificent 7 are telling us that nibbling equity markets will

provide an interesting return.

Conclusion: The

indicators on the banking situation deteriorated, whilst other indicators

are mostly neutral. The macro-economic situation between Europe and the US is diverging

to the advantage of the latter, even if in both cases public finances are in

disarray. The magnificent 7 are telling us that nibbling equity markets will

provide an interesting return.

2011 was bumpy and 2012 will be no less hectic.

Continue investing in high yielding equities / net cash

companies with a strong franchise and look at strong brands in fast growing

economies.

Sources:

http://marketsandbeyond.blogspot.com/2011/02/magnificent-7-and-equity-markets-review.html

US Department of the Treasury: Monitoring the economy

http://www.treasury.gov/resource-center/data-chart-center/monitoring-the-economy/Documents/monthly%20ECONOMIC%20DATA%20TABLES.pdf

S&P/Case-Shiller Home Price Indices

http://www.standardandpoors.com/servlet/BlobServer?blobheadername3=MDT-Type&blobcol=urldocumentfile&blobtable=SPComSecureDocument&blobheadervalue2=inline%3B+filename%3Ddownload.pdf&blobheadername2=Content-Disposition&blobheadervalue1=application%2Fpdf&blobkey=id&blobheadername1=content-type&blobwhere=1245326665736&blobheadervalue3=abinary%3B+charset%3DUTF-8&blobnocache=true

Markit (via Business Insiders): Manufacturing PMI indices by country

http://www.businessinsider.com/chart-of-the-day-manufacturing-pmis-january-2011-vs-december-2011-2012-1?nr_email_referer=1&utm_source=Triggermail&utm_medium=email&utm_term=Money%20Game%20Chart%20Of%20The%20Day&utm_campaign=Moneygame_COTD_010312